The role of the liquidity providers of cryptocurrency: development of the full potential of decentralized exchange

While the world of cryptocurrency continues to grow, a new generation of players appeared: liquidity suppliers. These persons and organizations have revolutionized the way decentralized stock exchanges (Dexs) and provide critical services that improve the efficiency, stability and experience of the market user. In this article we will deepen the world of liquidity suppliers and their effects on the Dexs.

What are liquidity suppliers?

The liquidity providers of cryptocurrencies refer to individuals or organizations that offer Dexs liquidity by offering their activities for trading. This can be done by the form of different types of coins such as stablecoin, tokens or even traditional cryptocurrencies. In this way, they help to guarantee market stability and prevent the formation of price bubbles.

Why are liquidity suppliers important?

Liquidity providers play an important role in maintaining the integrity of the Dex:

- Price support : If the prices swim wildly, the liquidity suppliers inject several coins onto the market to maintain the level of support and prevent an acute decline.

2

- Increase in liquidity

: Liquidity suppliers can increase the available liquidity by providing new trading activities and enabling users to buy or sell more tokens.

- improved user experience : With constant liquidity offers, the Dex becomes more user -friendly, reduces friction and increases the overall experience.

Types of liquidity suppliers

There are different types of liquidity suppliers of cryptocurrencies:

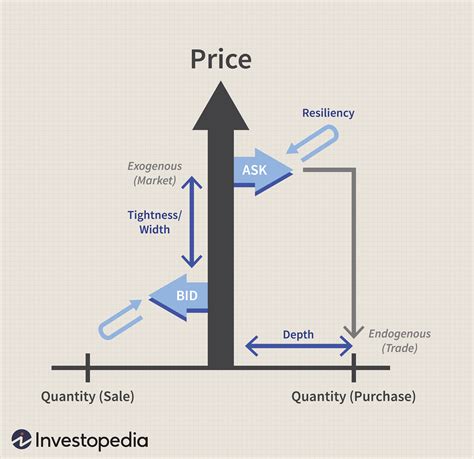

- Market Makers (mm) : MM are companies that buy and sell activities to create market depths. They set prices for trading and generate entrances from the commissions.

2

- Pools : The pools include more people or organizations who work together to group their resources and offer liquidity.

Effects on the decentralized exchange

The presence of liquidity suppliers has a significant impact on the Dex:

- Increase in liquidity : The addition of new liquidity providers increases the available liquidity and enables more trading opportunities.

2

- Reduced slips : With greater liquidity, users can act with fewer slip (edges of the error) to improve the experience of the overall user.

- improved user experience : Due to a constant liquidity offer, the Dex becomes more intuitive, reduces friction and increases the overall experience.

Examples of liquidity suppliers

Several remarkable liquidity suppliers have made a significant contribution to the world of cryptocurrency:

- Binance : Binance, a Dex leader, was crucial to promote market stability and deliver liquidity.

2

- Kraken

: Kraken, another Dex of the celebrities, offers liquidity through its “Market Maker” program.

Diploma

The role of liquidity suppliers in cryptocurrency has revolutionized the way of how decentralized exchange is active. By providing liquidity, these people and organizations have contributed to maintaining market stability, increasing the available liquidity and improving the experience of the users. While the landscape of cryptocurrency is developing, it is important that the Dexs remain vigilant with regard to liquidity management in order to ensure regular and efficient commercial experience.

Recommendations for Dexs

To maximize their effects, Dexs can take into account:

1.