The art of transaction of cryptocurrencies with psychology: Unlocking the best decisions

In the world of cryptocurrency trading, emotions play a significant role in decision making. Markets can be unpredictable and volatile, which makes it difficult to browse through uncertain periods. However, by understanding the psychology behind the trading, you can develop a more informed approach for risk management and maximizing yields. In this article, we will deepen in the world of psychological trading techniques and provide actionable advice on how to capitalize on human behavior to make better decisions.

Transaction psychology

Research has shown that people are connected with emotions that can have a significant impact on our decision -making processes. Here are some key psychological ideas to consider:

- Loss aversion : People tend to be more afraid of losses than to appreciate earnings, which leads to excess trust and impulsive decisions.

- Confirmation prejudice : We tend to seek information that confirms our preconceived notions, while ignoring contradictory evidence.

- Anchoring effect : Our initial estimate of a market price can influence our subsequent judgments, which makes it difficult to adjust the basic data.

Psychological trading techniques

To overcome these cognitive prejudices and make more informed trading decisions, you can use the following psychological techniques:

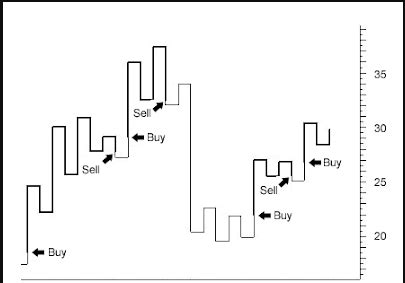

- Stop-piercing orders : Set clear stop loss to limit potential losses and avoid making emotional decisions.

- Risk management : Diversify -your portfolio to minimize exposure to any market or active, reducing dependence on a single trade.

- The average costs in dollars : Invest a fixed amount of money at regular intervals, regardless of market performance, to reduce calendar risks and to avoid emotional decisions.

- Emotional contagion : Recognize when others around you are trading in certain ways and adjusting -vis the strategy accordingly. For example, if friends or colleagues constantly buy Bitcoin, it can be a sign that the price is due for a correction.

- News based decisions : Stay informed about news and market events to make more informed decisions, but avoid excessive reaction to short -term market movements.

Case study: successful trading with psychological perspectives

Consider Tom’s example, a cryptocurrency trader who has constantly made better decisions by using psychological techniques:

- Before each transaction, Tom has set clear levels of stop loss based on its risk management strategy.

- He used the average costs in dollars to invest in cryptocurrencies at regular intervals, regardless of market performance.

- When trading news -based assets such as Bitcoin, Tom waited until he understood the basic data before making a decision.

Actable tips for improving your trading psychology

To unlock the maximum potential as a cryptocurrency trader, try these acting tips:

- Develop emotional control : Recognize when emotions influence your decisions and take action to manage them.

- Stay informed, but not excessive

: keep up to date with news and data on the market, while maintaining objectivity and avoiding emotional reactions.

- Practice Mindfleness : Regular Mindulness exercises can help you stay present and focus on the trading process.

- Set clear goals

: Set a clear understanding of your trading goals and risk tolerance to guide your decision making.

Conclusion

Trading cryptocurrencies with psychological perspectives requires a combination of knowledge, discipline and self -awareness. Understanding how emotions affect our decisions and using techniques, such as Stop-Loss commands, risk management and news-based monitoring, you can develop more informed strategies in the world of cryptocurrency transactions.