How to analyze the feeling of the market for better exchange of cryptocurrency

The cryptocurrency market has experienced significant volatility in recent years, which makes traders difficult to make informed decisions. Analysis of market feelings is a key aspect of trading which can have a significant impact on the performance of a trader. In this article, we will explore the importance of analyzing the feeling of the market and providing advice on how to do it effectively.

What is the feeling of the market?

The feeling of the market refers to global opinion or the attitude of investors and traders about the current state of the cryptocurrency market. It encompasses various aspects such as investor confidence, market volatility and psychological factors that influence purchasing and sale decisions.

Types of analysis of market feelings

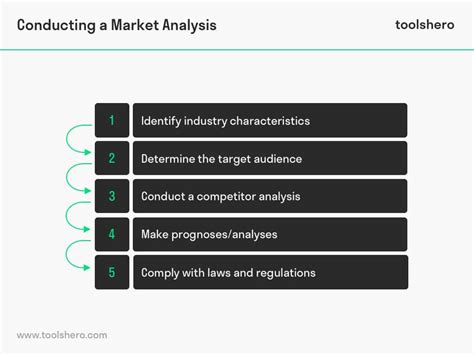

There are several ways to analyze the feeling of the market, including:

- Fundamental analysis : Examine the financial statements, economic indicators and industry trends to assess the overall health of a business or sector.

- Technical analysis : Analysis of graphics, models and trends in price movements to identify potential purchase and sale signals.

- Monitoring of social media : Follow -up of online discussions, tools for analyzing feelings and social media platforms to understand the opinions and emotions of the market.

- Economic indicators : Monitoring of economic growth rates, inflation, interest rates and other macroeconomic factors that can have an impact on the cryptocurrency market.

Why is the analysis of market feelings important in trading of cryptocurrencies?

The analysis of market feelings is crucial in the cryptocurrency trade for several reasons:

- Risk management : Understanding the feeling of the market helps traders to identify potential risks and opportunities, allowing them to make informed decisions on their trading strategy.

- Identification of trends : Analysis of the feeling of the market can reveal underlying trends that may not be obvious from traditional indicators, such as price movements or technical analysis.

- Predictive power

: By analyzing the feeling of the market, traders can better understand the potential price movements and predict future market developments.

- Improvement of commercial decisions : The analysis of market feelings allows traders to make more enlightened decisions, avoiding impulsive transactions based on emotions rather than on data -based analysis.

Advice to analyze the feeling of the market in the trading of cryptocurrencies

To effectively analyze the feeling of the market, follow these tips:

- Use a combination of indicators : Use several tools and indicators, such as fundamental analysis, technical analysis, social media monitoring and economic indicators, to acquire a complete understanding of the market.

- Focus on key themes : Identify the themes or dominant trends on the market, such as the growing interest in certain cryptocurrencies or the growing confidence of investors.

- Monitor the feeling from several sources : Follow data from various sources, including financial media, social media platforms and online forums to obtain a well -balanced vision of market opinions.

- Keep an eye on psychological factors : Understand how emotions such as fear, greed and excitation can influence market decisions and adjust your analysis accordingly.

- Stay up to date with market events : regularly examine economic indicators, press releases and regulatory updates to remain informed of market developments.

Example of analysis:

Let’s analyze the feeling of Bitcoin (BTC) in recent weeks:

- Basic analysis:

+ The company’s financial statements show a drop in income, which can lead to the most cautious of investors.

+ Economic indicators such as interest rates and inflation growth rates indicate an increasing uncertainty.

- Technical analysis:

+ The graphic models suggest a potential purchase signal at the current price level.