“Crypto, Miner, Market Correlation, Perpetual Futures: Understanding the Complex Relationship”

The world of cryptocurrency has grown exponentially in recent years, with millions of investors flocking to trade on platforms like Coinbase, Binance, and Kraken. One of the key drivers behind this surge in popularity is the emergence of miners, who use specialized hardware to validate transactions on public blockchains.

Miners play a crucial role in maintaining the integrity and security of cryptocurrency networks, as they are responsible for solving complex mathematical problems that help to secure the network and verify transactions. In return for their efforts, miners are rewarded with newly minted coins or tokens, which have historically been pegged to traditional fiat currencies at a fixed exchange rate.

However, the relationship between crypto prices and miner activity has become increasingly correlated in recent years. As mining power increases, it could lead to a surge in demand for cryptocurrency, causing prices to rise rapidly. Conversely, when miners are slowed down by increased competition or supply chain disruptions, prices tend to fall.

This correlation is not just limited to traditional cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The price of other altcoins, such as those derived from stablecoins, has also become increasingly correlated with miner activity. For example, the price of Litecoin (LTC) was highly correlated with mining power in 2018, when the algorithm was upgraded to increase its block reward.

But what does this mean for investors? While correlation can be a powerful force in driving up prices, it’s also essential to understand that past performance is not necessarily indicative of future results. In fact, some altcoins have experienced significant price drops despite increased miner activity, such as the collapse of Terra (LUNA) and Cosmos (ATOM).

Perpetual futures contracts, on the other hand, offer a unique opportunity for investors to speculate on cryptocurrency prices without actually buying or holding physical assets. These contracts allow traders to lock in profits at a fixed price, regardless of market fluctuations.

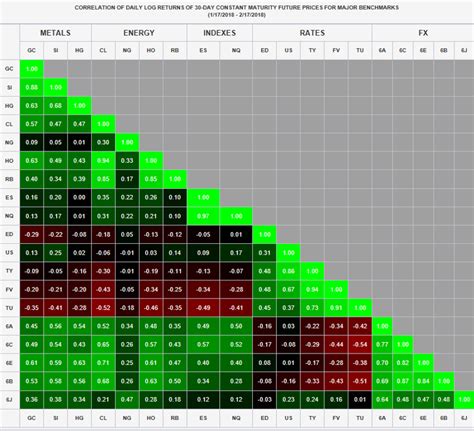

Perpetual futures are traded on centralized platforms such as CME Group and IG Markets, where they are often correlated with traditional financial markets, such as the S&P 500 index. This means that when prices rise on perpetual futures, it can lead to higher prices for other assets in the broader market.

Key Takeaways:

- Cryptocurrency miners are increasingly correlated with cryptocurrency prices: As mining power increases, so too do demand and supply rates, leading to rapid price rises or falls.

- Perpetual futures contracts offer a unique opportunity for speculation

: Locking in profits at a fixed price can be attractive to investors who want to hedge against market volatility.

- Market correlation is not always reliable: While correlation can drive up prices, past performance does not guarantee future results.

- Stablecoins have become increasingly correlated with mining power: The rise of stablecoin-backed cryptocurrencies has led to increased interest in perpetual futures contracts.

Investor’s Guide:

If you’re new to cryptocurrency investing, it’s essential to understand the relationship between miner activity and price fluctuations. Here are some key takeaways:

- Monitor news and market trends related to mining and cryptocurrency prices.

- Set up a risk management strategy that includes hedging against potential price drops or increases in miner activity.

- Consider using perpetual futures contracts as a speculative tool, but be aware of the risks associated with correlated markets.

By understanding the complex relationship between crypto miners, market correlation, and perpetual futures, investors can make more informed decisions about their investments.